Shareholders first

According to the “shareholder first”-perspective a company should be run to maximise the long-term profits of the shareholders. The shareholders own and control the company, they risk their investment, and they therefore have the right to the profits of the company operations. Employees, customers and suppliers are important but only as means to an end. Companies must operate within laws and regulations, but they do not have any particular social responsibility.

In 1970, Milton Friedman, Nobel-price winning economist, wrote an essay in the New York Times magazine backing this perspective. In his essay, he famously writes that there is no such thing as a social responsibility for business. “…there is one and only one social responsibility of business -to use its resources and engage in activities designed to increase its profits.” (Friedman 1971).

Only people can have responsibilities. Only humans can have responsibilities. If a company breaks the law, the manager or person who took the decision is the responsible.

Social investments as theft. Managers are employed to carry out the intentions of the shareholders, which normally is to maximise profits. If the manager chooses to spend company resources on pursuing social goals, he is essentially taking money away from the owners (or customers, if this leads to higher prices, or from employees, if this leads to lower salaries).

Taxation without legitimacy. By using resources on promoting social goals, the businessman is imposing taxes on society, without expertise in this area, and no legitimacy since the decision has not gone through any political process. If the owner or manager wants to support social issues, they can do this with their own money.

CSR can be beneficial. Friedman acknowledges that taking social responsibility sometimes can be beneficial. A company that invests in the local community may get better motivated or skilled workers or better local government and benefit from it. But then it is not social responsibility, but profit-maximization.

Rules of the game. Friedman does not mean that corporations have no responsibilities – he explicitly states that corporations must conform to “the basic rules of the society, both those embodied in law and those embodied in ethical custom”…and “so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud”.

Stakeholder theory

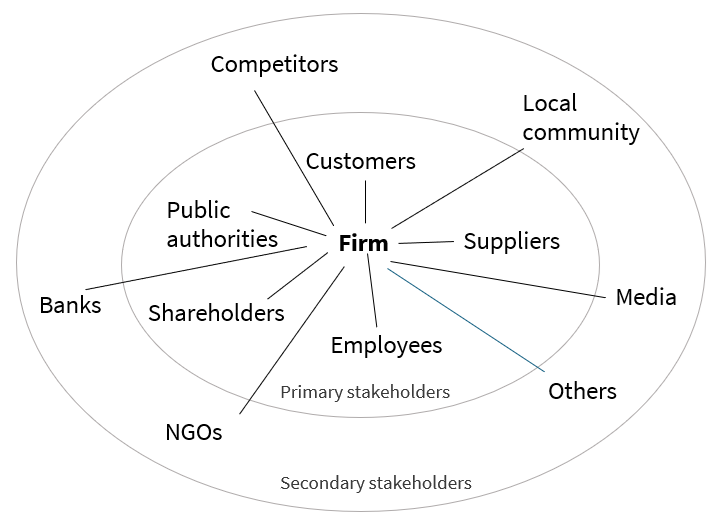

An alternative to the shareholder-first perspective is stakeholder theory, developed in the 1980s, by Richard E. Freeman and others. According to stakeholder theory, corporations should operate in a way that benefits all stakeholders. A stakeholder is typically defined as “groups and individuals who can affect or are affected by the achievement of an organization’s mission” (Freeman 1984). Shareholders are an important stakeholder, but it is not the only stakeholder that matters. In stakeholder theory, each stakeholder has intrinsic value and should be considered and listened to.

Primary and secondary stakeholders. Owners, employees, customers and suppliers are almost always stakeholders, since few companies exist without these. Other stakeholders can be local communities, banks/financers, non-governmental organizations, authorities, media, competitors, and many more. Owners, employees, customers, suppliers and public authorities are often called primary stakeholder groups, since the company could not survive without them. Secondary stakeholders are stakeholders that are not engaged in transactions with the company and whom the company can survive without (Clarkson 1995).

Nature. Should nature have status as a stakeholder? Nature does not fit well into the definition and has typically been excluded from stakeholder status. Some argue that nature can be represented indirectly through other stakeholders. Others claim that nature is a living system that all human activity including business firms depends on and should therefore have stakeholder status (Starik 1995).

Stakeholder prioritization. The most difficult is to prioritize between the different stakeholders. Take an example: Should the employees get higher salaries? This must mean either increasing prices (at the expense of customers) or cuts for another group. Stakeholder theory does not have the answer to how this should be done, but this is an important job for management. Some have suggested that the legitimacy, power and urgency of the stakeholder should influence their treatment (Mitchell et al 1997).

Layoffs at Møller Mobility Group. Møller Mobility Group imports the Volkswagen cars to Norway and the Baltics. With expectations of lower car sales in 2023 and 2024, Møller announced employee layoffs in 2023. The company did not want to disclose exactly how many, but industry estimates were that around 100-150 of the 4000 employees had to leave the company. In March 2024 the company announced that they had a financial result of 1.549 million NOK in 2023, down from 2.649 MNOK in 2022. Source: Møller Mobility Group.

Stakeholder theory is used in many ways. The theory can be both (Donaldson & Preston 1995):

- descriptive (describing what a company does

- instrumental (suggesting that the stakeholder perspective is useful for other, ultimate goals, such as profit maximization)

- normative (suggesting that this is the morally right thing to do)

Stakeholder dialogue

Large companies talk a lot about their corporate responsibility and sustainability initiatives and results. Does this mean that the stakeholder perspective has “won” over the shareholder perspective? Not necessarily. While large firms communicate more about responsibility and their stakeholders now than in the 1970s, this may be mostly at the rhetorical level, and that they still put most importance on shareholders.

Stakeholder impact. On a practical level, most large companies now regularly do stakeholder analysis and stakeholder dialogue. In stakeholder analysis the company maps out their important stakeholders and present and discuss issues affecting them and the relationship.

Stakeholder dialogue is the interaction between the firm and the various stakeholders, with the intention of mutual learning and understanding (Habisch et al 2011). The idea is that the company must know the needs of the various stakeholders to be able to respond to them. The stakeholder dialogue can be done through conferences, one-to-one meetings, surveys, complaints systems, and other ways.

Stakeholder management at Telenor Group

Telenor Group is the leading Norwegian telecom company, with a strong presence in the Nordics and Asia. In total the company has around 8 billion EUR in annual sales, 200 million mobile subscribers and 11 000 employees. Telenor is based on the old Norwegian public telecommunication company, and the Norwegian state holds more than 50% of the shares. In their annual report, Telenor specifically mentions that they create value for stakeholders, including shareholders. “Telenor creates value for our stakeholders through the services we provide. We connect people and societies while also driving shareholder remuneration and return on capital” (p. 12). According to CEO Sigve Brekke, “We are building a smarter and more flexible Telenor – a company that creates value for customers, society, and shareholders,” (p. 8).

Telenor defines employees, investors, customers, civil society and organizations, policy makers/governments, general public and communities, and partners and industry peers as the key stakeholders. Telenor communicates with these groups using meetings, presentations, conferences, and surveys. Some stakeholders such as employees have formal representation in committees and formal meeting points. Telenor is member of a wide range of industry associations. Customers, for example, have expectations regarding online safety, digital access and inclusion, climate and environmental action, e-waste, data privacy, responsible sourcing, and company position on social issues. Dialogue with customers is done through customer surveys, tracking of customer service contacts, and industry forums. Source: Telenor Annual report.

Stakeholder impact

The following table provides examples of how a company impacts stakeholders, how the stakeholders impact the company, and typical ways of relating to the stakeholder (not exhaustive).

| Stakeholder | Company’s impact on stakeholder | Stakeholder’s impact on company | Stakeholder dialogue tools |

| Owners | Dividends/increased value of shares, status, losses/decreased value | Can hire & fire management, decides board, shareholder votes | Board meetings, annual meetings, investor conferences/calls |

| Employees | Salaries, working conditions, social relations, skills and knowledge | Skill level, motivation, hiring costs/turnover, can quit | Labour unions, employee representatives, meetings, surveys, complaints |

| Customers | Quality of product and services through the whole lifetime, prices, status | Decides where to buy, price levels, can withdraw support/stop buying | Meetings, service interactions, complaints, customer satisfaction surveys |

| Suppliers | Price level, terms of agreement, respect of contract | Terms of agreement, respect of contract, innovation, can withdraw support/stop supplying | Meetings, direct communication |

| Public sector/authorities | Jobs, tax income, innovations and economic growth | Taxes, laws & regulation, education and welfare systems | Meetings, public consultations, lobbying, industry associations |

Reflection questions

- How strong do you think Friedman’s argument were for a “profit-only” focus?

- What could be some good principles for balancing the needs of the different stakeholders?

- Do you think that Telenor are honest when they say that they want to create value for all, not just for their owners?

Learn more

Smith, H. J. (2003). The Shareholders vs. Stakeholders Debate. MIT Sloan Management Review, 44(4), 85–90.

References

Clarkson, M. B. E. (1995). A Stakeholder Framework for Analyzing and Evaluating Corporate Social Performance. The Academy of Management Review, 20(1), 92–117. https://doi.org/10.2307/258888.

Donaldson, T., & Preston, L. E. (1995). The Stakeholder Theory of the Corporation: Concepts, Evidence, and Implications. The Academy of Management Review, 20(1), 65. https://doi.org/10.2307/258887.

Freeman, R. E. (1984). Strategic management: A stakeholder approach. Pitman Publishing Inc..

Friedman, M. (1970, September 17). The Social Responsibility of Business is to Increase its Profits. The New York Times Magazine.

Habisch, A., Patelli, L., Pedrini, M., & Schwartz, C. (2011). Different Talks with Different Folks: A Comparative Survey of Stakeholder Dialog in Germany, Italy, and the U.S. Journal of Business Ethics, 100(3), 381–404. https://doi.org/10.1007/s10551-010-0686-8.

Mitchell, R. K., Agle, B. R., & Wood, D. J. (1997). Toward a Theory of Stakeholder Identification and Salience: Defining the Principle of Who and What Really Counts. The Academy of Management Review, 22(4), 853. https://doi.org/10.2307/259247.

Starik, M. (1995). Should trees have managerial standing? Toward stakeholder status for non-human nature. Journal of Business Ethics, 14(3), 207–217. https://doi.org/10.1007/BF00881435.